The Federal Government has ruled out any plan to suspend the implementation of the Nigerian Tax Act and the Nigerian Tax Administration Act, reaffirming that both laws will come into force on January 1, 2026, despite concerns raised by the House of Representatives over alleged discrepancies in the gazetted versions.

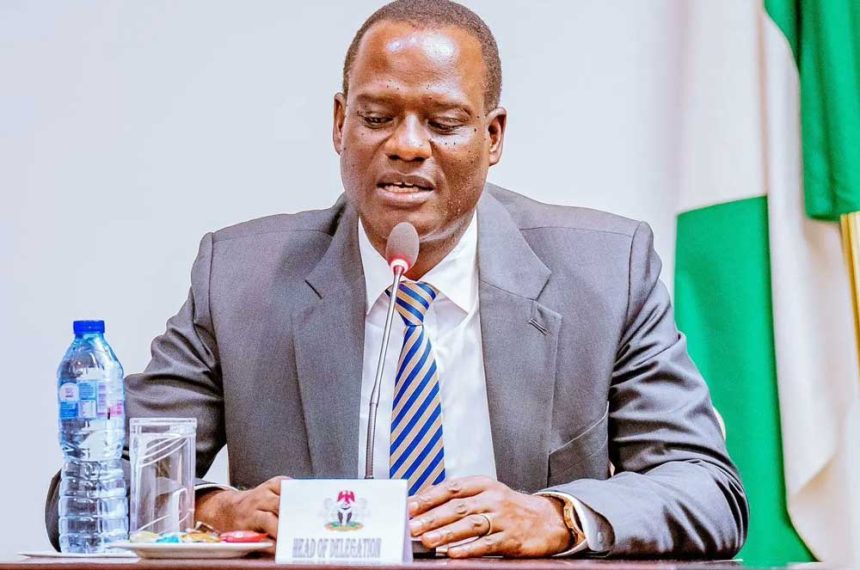

Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, stated this while addressing journalists after a meeting with President Bola Ahmed Tinubu, stressing that the implementation timeline remains unchanged.

Oyedele said the tax reform programme is a central pillar of the Tinubu administration’s economic agenda, designed to reduce the tax burden on citizens, stimulate economic growth, and promote fairness and transparency within the tax system.

His remarks followed recent deliberations by the House of Representatives Committee, which is investigating claims that certain provisions in the final versions of the tax laws differed from what lawmakers originally passed.

While welcoming the engagement of the National Assembly, Oyedele noted that the Federal Government remains open to dialogue and corrective action where necessary. However, he emphasised that such discussions would not delay the scheduled commencement of the two remaining tax laws.

According to him, four major tax reform laws have been enacted under the ongoing reform programme, with two already operational. He explained that the Nigerian Revenue Service Establishment Act and the Joint Revenue Service Establishment Act took effect on June 26, 2025, ahead of the broader reforms, to allow newly created institutions to begin operations and build capacity.

The remaining statutes—the Nigerian Tax Act and the Nigerian Tax Administration Act—are scheduled to take effect on January 1, 2026, as initially planned.

“The plan to commence these laws on January 1, 2026, remains firm because the reforms are structured to deliver relief to the Nigerian people,” Oyedele said.

Highlighting the expected benefits of the reforms, he disclosed that about 98 per cent of Nigerian workers would either pay no Pay-As-You-Earn (PAYE) tax or pay significantly lower amounts. In addition, approximately 97 per cent of small businesses would be exempt from corporate income tax, value-added tax, and withholding tax.

Oyedele added that larger companies would also benefit from reduced tax liabilities under the revised framework, noting that the reforms are aimed at inclusivity, shared prosperity, and sustainable economic growth rather than increasing tax rates.

He said the new tax system prioritises expanding economic activity, broadening the tax base, and improving voluntary compliance.

The committee chairman further revealed that the tax reform bills spent about nine months at the National Assembly between October 2024 and June 2025, allowing ample time for legislative scrutiny and preparation ahead of implementation.

Since the laws were signed, he said the government has focused on capacity building, system upgrades, and extensive stakeholder engagement to ensure a smooth rollout.

Oyedele also noted that the reforms have eliminated what he described as wasteful and distortionary tax incentives, a move expected to improve efficiency and equity within the tax system.

Describing tax reform as a continuous process, he said the framework would continue to evolve based on feedback and economic conditions but maintained that the January 2026 implementation date for the two remaining tax laws remains unchanged.