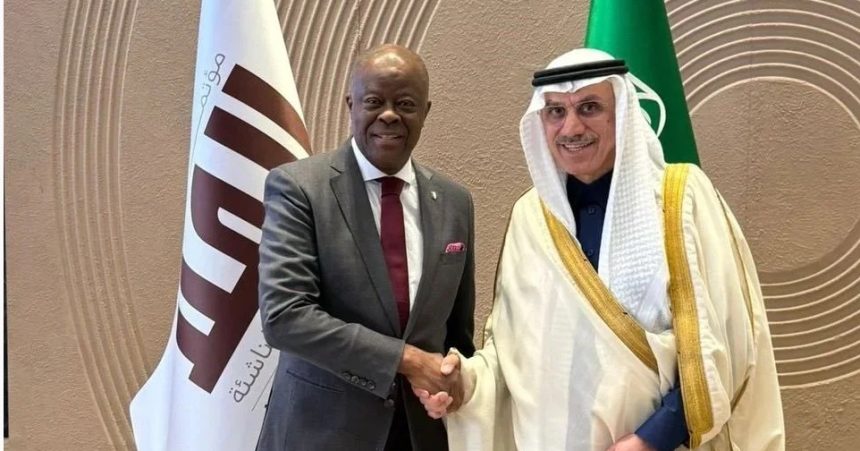

Nigeria’s real estate sector stands to benefit from ongoing global discussions on trade systems, monetary policy, and emerging market influence, following remarks by the Finance Minister at a recent forum in Saudi Arabia.

Addressing global peers, the minister emphasized that emerging economies contribute far more to global growth than their current influence over international financial systems suggests. He also underscored the strategic role of Gulf economies in directing trade, investment, and long-term capital allocation.

For Nigeria, deeper engagement with these global partners could unlock new sources of development finance and long-term funding, critical for addressing the country’s housing deficit. With urban populations expanding rapidly, demand for residential, mixed-use, and urban infrastructure projects outpaces current supply.

Global Capital and Housing Finance

The minister’s remarks highlight how global financial reforms could enable foreign investment in residential and commercial developments, real estate-focused private equity, and sovereign-backed funds, improving mortgage finance and infrastructure delivery. Improved confidence in Nigeria’s economic stability could further encourage institutional investors to participate in the mid-market housing segment, where affordability gaps remain wide.

Trade Systems and Construction Costs

Global trade adjustments affect the supply of imported construction materials such as cement, steel, and equipment. Stronger trade partnerships and smoother supply chains could reduce cost volatility, shorten project timelines, and stabilize housing delivery, ultimately lowering sales prices and rents.

Monetary Conditions and Housing Demand

Macro-stability, interest rates, and inflation expectations remain key drivers of housing demand. Alignment between global capital markets and domestic policy reforms could ease pressures on mortgage financing, developer loans, and institutional investment, creating a more resilient property market.

Strategic Questions for Nigeria’s Property Sector

Experts suggest policymakers and developers focus on:

-

Channeling foreign direct investment toward affordable housing, not just luxury segments.

-

Encouraging Gulf and institutional capital to support mixed-income residential schemes.

-

Redesigning public-private partnerships to unlock land for development.

-

Reforming the mortgage market to attract long-term international investors.

-

Reducing building costs through trade integration.

Looking Ahead

As Nigeria engages in global economic forums like the Al Ula conference, it is clear that housing outcomes are linked to capital flows, trade networks, and monetary systems. Real estate stakeholders must stay agile and policy-aware to capture opportunities arising from an evolving global financial landscape.