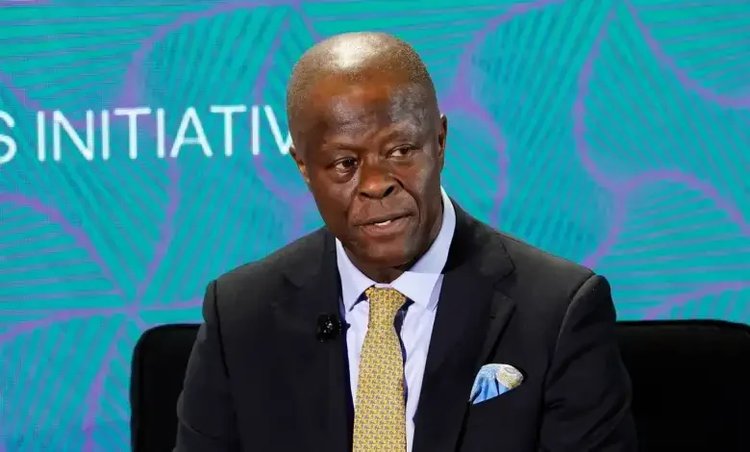

The Federal Government has indicated that cooling inflation in Nigeria could pave the way for lower debt servicing costs, as Finance Minister and Coordinating Minister of the Economy, Wale Edun, signaled the possibility of future interest rate reductions. The remarks came during the Abu Dhabi Sustainability Week, where Edun highlighted the potential fiscal benefits of moderating inflation trends for the 2026 federal budget.

Speaking to journalists, Minister Edun commended the Central Bank of Nigeria (CBN) for its efforts in stabilizing the economy, noting that the apex bank’s monetary tightening measures had successfully curbed inflationary pressures that reached record highs in late 2024.

“With inflation gradually declining, there is now an opportunity to reduce borrowing costs, which will ease the fiscal burden of debt servicing and provide the government more room to implement developmental priorities,” Edun said.

Monetary Tightening and Fiscal Relief

The CBN had previously raised the Monetary Policy Rate (MPR) aggressively to contain soaring prices, peaking at a historic high. Following the moderation in inflation, the bank cut the MPR by 50 basis points in September 2025, bringing it to 27%. Minister Edun noted that further reductions could follow if inflation continues its downward trajectory, signaling potential relief for both government finances and private sector borrowers.

Lower interest rates would reduce the proportion of federal revenue allocated to debt obligations, which currently accounts for over 25% of the proposed 2026 budget, amounting to approximately ₦15 trillion out of a total ₦58 trillion spending plan. The budget deficit is projected at roughly ₦24 trillion, underscoring the significance of any reduction in borrowing costs.

Structural Reforms and Revenue Mobilisation

In addition to potential monetary easing, the federal government is strengthening fiscal discipline and revenue mobilisation. Ministries, Departments, and Agencies (MDAs) have been instructed to fully migrate to automated payment platforms, reducing cash leakages and enhancing transparency.

Other funding initiatives for 2026 include:

- Privatisation proceeds from the sale of state-owned assets.

- NNPC divestments, focusing on strategic sales to boost foreign exchange inflows.

- Production increases in crude oil to stabilize revenues.

- Outlook for Investors and Policymakers

Finance Minister Edun’s remarks indicate a potential shift from crisis management to sustainable fiscal policy, leveraging lower inflation to ease debt costs and support economic growth. Policymakers and investors will monitor inflation trends, debt service ratios, and revenue mobilisation efforts, as these factors will directly impact Nigeria’s financial stability in 2026.