The Federal Ministry of Finance has announced plans to take over development finance and quasi-fiscal responsibilities previously handled by the Central Bank of Nigeria (CBN), marking a major shift in how Nigeria funds priority sectors of the economy.

The move comes nearly two years after the CBN stepped back from directly financing development programmes, a decision that created funding gaps in long-term projects across infrastructure, energy, and other strategic sectors.

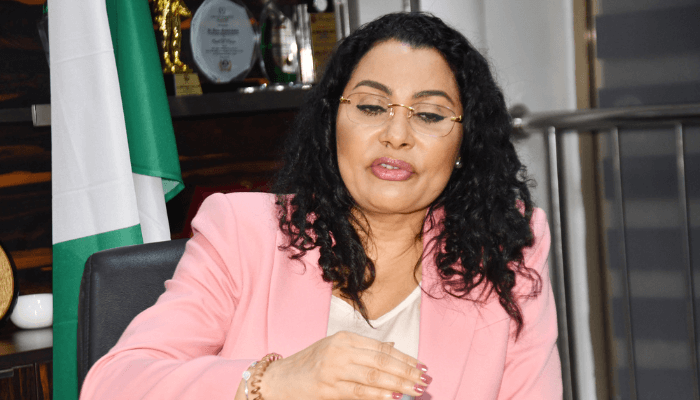

In a statement issued on Thursday, the Minister of State for Finance, Doris Uzoka-Anite, said the ministry would roll out a comprehensive framework to guide the implementation of a forward-looking development finance strategy.

She explained that Development Finance Institutions (DFIs) would play a central role in supporting Nigeria’s investment and growth agenda. According to Uzoka-Anite, Nigeria will require an estimated ₦246 trillion in long-term, patient capital through 2036 to meet its development ambitions.

“The Federal Government recognises DFIs as critical partners in de-risking priority sectors, building investor confidence, and mobilising private capital at scale,” she said.

Institutions such as the Bank of Industry (BOI) and the Nigerian Export-Import Bank (NEXIM) are expected to provide long-term funding, concessional financing, technical support, and risk-sharing mechanisms in sectors where private investors have been reluctant to commit funds despite strong fundamentals.

Key focus areas include infrastructure, energy transition, agribusiness value chains, healthcare, climate-resilient industries, and digital public infrastructure.

Uzoka-Anite outlined a four-point strategy to strengthen domestic DFIs. This includes improving their capital base and balance sheets to support larger and longer-tenor transactions, implementing governance reforms to ensure stronger oversight and performance-driven management, and enhancing their risk-sharing and credit enhancement capabilities.

The strategy also emphasises closer coordination with the Ministry of Finance, particularly in providing treasury support, sovereign guarantees, and policy-backed lending. In addition, the government plans to leverage domestic and international partnerships to accelerate capital mobilisation and reduce project execution timelines.

She added that Nigeria’s ongoing reforms, clearer policies, and improved execution discipline provide a solid foundation for DFIs to deploy capital effectively and deliver measurable impact.

The development follows the CBN’s withdrawal from direct development finance interventions. Shortly after assuming office, CBN Governor Olayemi Cardoso announced that the apex bank would discontinue funding development programmes. In December 2023, the CBN formally suspended new loans under its intervention schemes while focusing on recovering previously disbursed funds.

Uzoka-Anite reaffirmed the federal government’s commitment to supporting DFI-led initiatives aligned with national priorities, stressing the importance of policy consistency, institutional coordination, and effective implementation.