Federal Ministry of Finance to centralize investor engagement, streamline communication, and accelerate project execution across priority sectors.

The Federal Government of Nigeria has announced plans to establish a central investor desk within the Federal Ministry of Finance in 2026. The move aims to streamline communication with domestic and foreign investors, improve transparency, and restore confidence after years of macroeconomic volatility.

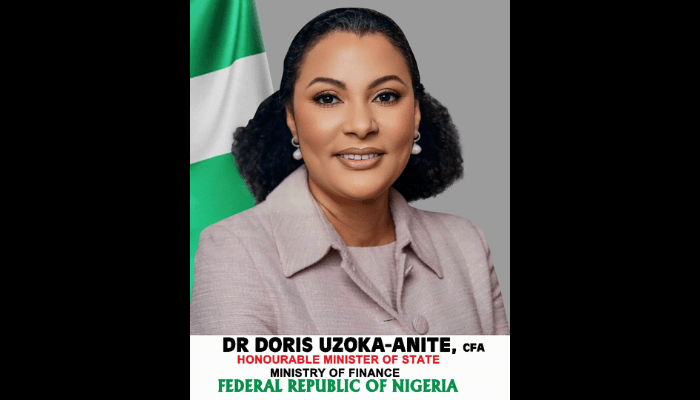

According to Doris Uzoka-Anite, Minister of State for Finance, the investor desk will act as a single interface between the government and investors, development finance institutions, credit rating agencies, and market analysts. This approach addresses one of the most persistent complaints among investors: fragmented communication and inconsistent policy signaling.

“To deepen investor confidence, improve transparency, and ensure sustained engagement with capital providers, the Federal Government will establish a central investor desk housed within the Ministry of Finance,” Uzoka-Anite said. “The platform will focus on consistent communication, timely disclosure, and proactive engagement on macroeconomic policies, reform progress, and project execution.”

Strategic Role and Objectives

The central investor desk forms part of a broader 2026 economic agenda designed to move Nigeria from a phase of stabilization into one of sustainable growth. The initiative follows two years of far-reaching reforms under President Bola Ahmed Tinubu, including exchange-rate unification, energy market restructuring, and fiscal tightening, which corrected long-standing market distortions but weighed on growth in the short term.

The desk will coordinate with the Disinflation and Growth Acceleration Strategy (DGAS), a joint framework implemented with the Central Bank of Nigeria (CBN) and other agencies, to ensure fiscal and monetary policies align and are clearly communicated to investors.

Officials say the platform will not only enhance transparency but also facilitate deal flow. It will focus on developing investment pipelines, deploying blended finance solutions, and accelerating the execution of priority projects in key sectors including:

- Energy

- Agribusiness

- Manufacturing

- Housing

- Healthcare

- Digital services

- Solid minerals

- Economic Impact

Nigeria aims to attract long-term capital at a time when global investment competition is intensifying. Analysts estimate the country will require about ₦246 trillion in long-tenor financing by 2036 to reach its growth goals, including expanding GDP to $1 trillion within a decade.

To support this, the government plans to deepen local capital markets, expand pension funds and insurance participation in infrastructure financing, and strengthen development finance institutions such as the Bank of Industry (BoI) and the Nigerian Export-Import Bank (NEXIM). These institutions are expected to anchor risk-sharing mechanisms that encourage private sector investment in previously underserved sectors.

Fiscal transparency reforms, including new tax laws and the Federal Revenue Optimization Platform, aim to boost compliance, enhance non-oil revenue, and give investors clearer insight into public finances. The government has also committed to restructuring domestic debt to reduce short-term interest burdens and ease pressure on financial markets.

“Credibility will be judged by delivery rather than declarations,” Uzoka-Anite emphasized. “By centralizing investor engagement and aligning it with macroeconomic coordination, Nigeria can convert its scale and reform momentum into sustained capital inflows, job creation, and faster growth starting in 2026.”

The establishment of a central investor desk signals a major step toward professionalizing Nigeria’s investor relations, improving fiscal transparency, and unlocking private and institutional capital for long-term national development.

As the government operationalizes DGAS and other financing strategies in the coming months, the platform is expected to transform Nigeria’s investment climate, making it more predictable, resilient, and attractive to global investors.