AG Mortgage Bank Plc (AGMB) has unveiled an ambitious five-year expansion strategy aimed at delivering one million mortgages by 2030 while targeting a 20 per cent return on equity (RoE) for shareholders, positioning the lender as a major driver of Nigeria’s housing finance transformation.

The plan, branded Project Momentum 2025–2030, outlines AGMB’s transition into a diversified financial services group with interests spanning mortgage banking, housing microfinance, real estate development, insurance, brokerage, and rental housing solutions.

Expansion Strategy and Housing Finance Growth

According to the bank, the strategy is designed to significantly expand its loan portfolio, grow its customer base, and deepen access to affordable and sustainable homeownership across Nigeria.

AGMB disclosed the details in its Q3 2025 Market Intelligence Report (MIR), which analyses economic and sectoral trends shaping Nigeria’s real estate and housing market. The report notes rising investor interest in real estate as a hedge against inflation, supported by easing inflationary pressures and more stable interest rates.

Nigeria’s Real Estate Market Outlook

The report highlights the scale of opportunity within Nigeria’s housing sector, projecting the residential real estate market to be worth $2.25 trillion by 2025. This demand underpins AGMB’s goal of originating one million mortgages within the next five years.

Beyond residential housing, the broader Nigerian real estate market is estimated at $2.61 trillion in 2025, with a projected compound annual growth rate (CAGR) of 6.87 per cent between 2025 and 2029, reaching approximately $3.41 trillion by 2029.

Growth is expected to be driven by rapid urbanisation, infrastructure investment, and ongoing housing policy reforms.

CEO Highlights Strategic Milestone

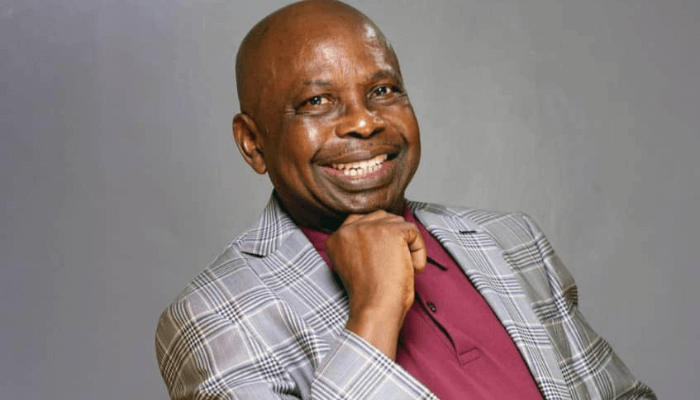

Speaking on the report, Managing Director and Chief Executive Officer of AG Mortgage Bank Plc, Ngozi Anyogu, described the period as a defining phase for the institution.

“In September 2025, we marked our 20th anniversary—two decades of innovation, resilience, and service to millions of Nigerians,” Anyogu said.

She added that the bank has evolved into a trusted provider of tailored housing finance solutions, with a renewed commitment to long-term value creation through integrity, innovation, and impact-driven growth.

Green Housing and Digital Innovation

As part of its expansion drive, AGMB has introduced new products including treasury solutions for institutional investors, sustainability-focused housing finance products, and digital-first platforms aimed at supporting SMEs and entrepreneurs.

The bank also plans to scale green and climate-resilient housing initiatives, aligning with Nigeria’s sustainability and climate goals.

Sector Performance and Outlook

The Market Intelligence Report shows improving fundamentals across the sector. Nigeria’s construction sector grew by 5.27 per cent in Q2 2025, while real estate contributed 12.80 per cent to GDP, expanding by 3.79 per cent during the period.

Looking ahead, the real estate sector is projected to grow between 6 and 8 per cent in 2025, with residential housing expected to expand at a CAGR of 7.55 per cent, reaching $3.01 trillion by 2029.

Urban population growth—particularly in Lagos, Abuja, and Port Harcourt—continues to fuel demand for affordable housing solutions.

Positioning for Long-Term Impact

With over 20 years of experience in housing finance, AG Mortgage Bank says it is well positioned to convert strong mortgage origination capacity into securitised, investor-grade assets, while expanding access to inclusive, technology-enabled, and sustainable housing nationwide.