The Financial Reporting Council of Nigeria (FRC) has announced plans to integrate Islamic finance services into the country’s national financial reporting framework.

The move involves adopting standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), the Council said.

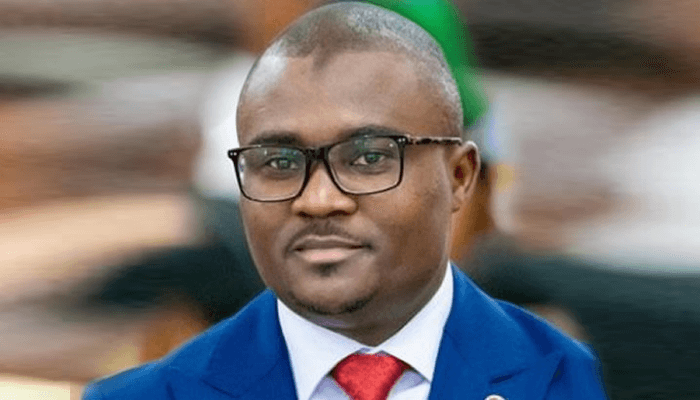

Rabiu Olowo, Executive Secretary and CEO of the FRC, revealed the initiative during the 7th Africa Islamic Finance Conference in Lagos, noting that it aligns with the Council’s mandate to set, monitor, and enforce financial reporting standards across Nigeria.

Olowo highlighted the rapid growth of Islamic finance in Nigeria, including expansion in Islamic banking, Sukuk issuances, Takaful insurance, and non-interest capital market products.

He stressed that the adoption of AAOIFI standards would ensure consistency, reliability, and global comparability in financial reporting for the sector.

“This sector has become a dynamic contributor to financial inclusion, infrastructure financing, and ethical investment alternatives. Integrating AAOIFI standards is both a regulatory necessity and a strategic step toward building trust and transparency in our financial system,” Olowo said.

Vice President Kashim Shettima, represented by the President’s Special Adviser on Economic Affairs, Tope Fasua, welcomed the move, emphasizing that Islamic finance is grounded in ethics, fairness, and shared prosperity.

Speaking at the conference, Muhammadu Sanusi II, 14th Emir of Kano and former Central Bank governor, praised the sector’s growth.

“Islamic financing primarily invests in real assets like roads, power plants, water systems, and digital networks. When applied effectively, it can significantly boost economic development,” Sanusi stated.

He further noted that Islamic finance is particularly suited for infrastructure projects, creating jobs and long-term value while promoting economic stability.

The FRC’s adoption of AAOIFI standards complements existing IFRS practices, providing a dedicated framework for the unique contracts and instruments used in Islamic finance. Officials say the move will strengthen transparency, support financial inclusion, and ensure that Nigeria’s Islamic finance sector continues to play a meaningful role in economic growth.