The bill which seeks to raise the capital base of the Federal Mortgage Bank of Nigeria (FMBN) to N100 billion has scaled through First Reading on the floor of the House of Representatives.

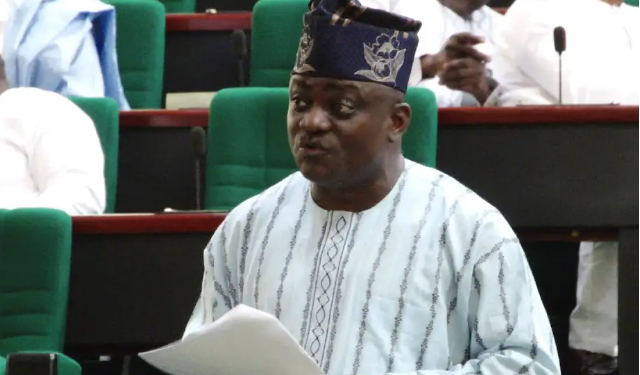

The private member bill was sponsored by the immediate past Chairman of the House Committee on Public Accounts, Hon. Wole Oke.

According to the Sponsor of the bill seen by housing tv Africa,the piece of legislation seeks to amend the Federal Mortgage Bank of Nigeria Act 1993, by including introducing a new Section 11 sub-subsections (2) and (3), permitting private sector investors to participate in the shareholding arrangement of the Bank.

The private member bill was sponsored by the immediate past Chairman of the House Committee on Public Accounts, Hon. Wole Oke.

According to the Sponsor of the bill seen by Nigerian Tribune, the piece of legislation seeks to amend the Federal Mortgage Bank of Nigeria Act 1993, by including introducing a new Section 11 sub-subsections (2) and (3), permitting private sector investors to participate in the shareholding arrangement of the Bank.

The sponsor seeks to amend Section 11 subsections (2) and (3) of the FMBN Act, 1993.

Clause 2 of the bill, seeks to amend Section 11(2) and (3) of the Act by including and replacing the current provision with a new provision.

“(2) – The authorised capital of the Mortgage Bank shall be One Hundred Billion Naira which shall be divided into 1,000,000,000 shares of N1.00 each and be subscribed and paid up at par by the Federal Government of Nigeria, Development Banks, Pension Fund Administrators and any other investor authorised by the Board of Directors.

“(3) The loan capital of the Mortgage Bank shall be provided by the by the Federal Government of Nigeria, Development Banks, Pension Fund Administrators and any other investor authorised by the Minister, based on such amount and on such terms as may be determined by the Board of Directors.”

Hon. Oke also seeks the amendment of Section 11 by introducing a new subsection 11(4) which provides that: “The shareholders of the Mortgage Bank shall be entitled to increase the authorised capital in order to accommodate more investment funds.”

In the same vein, the House is expected to commence debate on a bill which seeks to amend Section 85 of the 1999 Constitution.

According to Hon. Oke, Section 85 of the 1999 Constitution is to be amended by introducing a new subsection (7)(a) which states that: “Notwithstanding the provisions of subsection 6 of this Section, the Committees of both Houses ‘of the National Assembly responsible for public accounts shall exercise oversight over the activities of the Auditor-General for the Federation.

“(b) In furtherance on the powers conferred on the Committees of both Houses of the National Assembly responsible for public accounts, the Committees shall appoint an independent external auditor every year to audit the accounts, financial statements, and financial management and performance information of the Auditor General.

“(c) All expenditure of the Auditor – General for the Federation must be authorised by an Appropriation Act, Supplementary Appropriation Act or an Act passed in pursuance of section 81 of this Constitution and the release of appropriated funds from the Consolidated Revenue Fund shall be on a first line charge basis.”

According to the Explanatory Memorandum of the bill, the proposed legislation “seeks to amend the Constitution of the Federal Republic of Nigeria by amending section 85 to include a new subsection 7 (a), (b) and (c) which introduces provisions for the appointment of an external auditor to audit the accounts, financial statements, and financial management and performance information of the Auditor-General for the Federation.

“The Bill further seeks to subject all expenditure of the Auditor-General for the Federation to appropriation procedures and disbursement of funds on a first line charge basis.”