The Central Bank of Nigeria (CBN) has assured depositors of the safety of their funds in Nigerian banks, reiterating the health of deposit money banks in the country.

The apex bank, in a statement on Wednesday signed by its acting Director of Corporate Communications, Mrs Hakama Sidi-Ali, dismissed reports that about two banks would be nationalised following infractions in their acquisitions.

Recall that several media houses, Housing tv not included, had reported the federal government would take over the CBN-supervised banks after a report by CBN’s special investigator, Mr Jim Obazee.

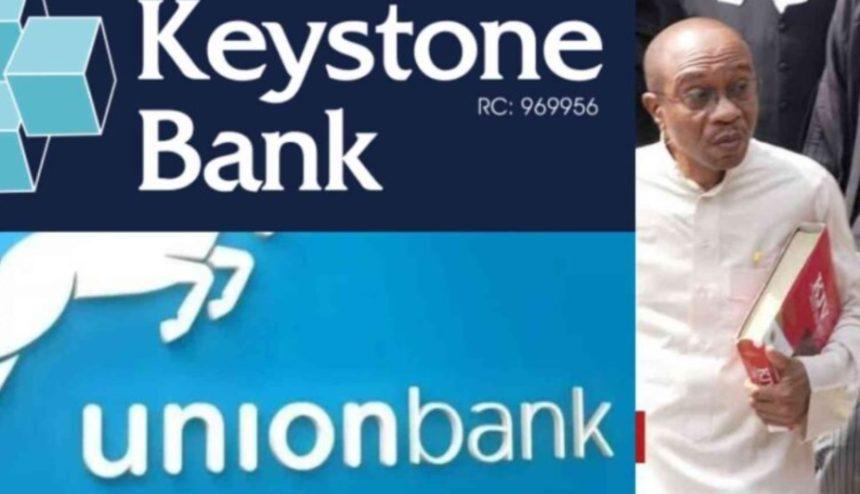

Mr Obazee, who was appointed in July 2023 by President Bola Tinubu had indicted ex-CBN governor, Mr Godwin Emefiele, in his report to the President, saying the ex-bank chief allegedly used proxies to set up two financial institutions — Union Bank and Keystone Bank.

This fuelled speculation that the apex bank might take over the two banks.

The former central banker was accused of acquiring Union Bank and Keystone Bank through several proxies from “ill-gotten wealth” and “without evidence of payment.

The CBN, in its statement, said, “The Central Bank of Nigeria has noticed reports, in certain media outlets, about a recommendation for the federal government to take over some CBN-supervised financial institutions.

RAED ALSO: National Housing Fund: Banks, insurers’ keeps owing… as HDAN threaten to sue CBN

“For the avoidance of doubt, Nigerian banks remain safe and sound. The CBN encourages the public to continue their regular activities without being alarmed by reports that have not emanated from the CBN about the health status of Nigerian banks.

“The CBN is fully equipped to carry out its statutory duty of upholding a stable financial system in Nigeria.

“We assure the general public and depositors about the safety of their funds in Nigerian financial institutions.

READ ALSO: National Housing Fund: Banks, insurers’ keeps owing… as HDAN threaten to sue CBN

“Bank customers are therefore advised to proceed with their banking transactions as usual, as there is no cause for concern.”

On its part, the Tropical General Investments (TGI) Group, which led the 2022 takeover through its Titan Trust unit, said in a statement on Sunday that the acquisition of Union Bank followed all the laid down rules and regulations.

The approximately $500 million used to finance the purchase from investors including Atlas Mara Ltd. was “transparent and unimpeachable,” adding that it was not a proxy as alleged.

Source: Businesspost