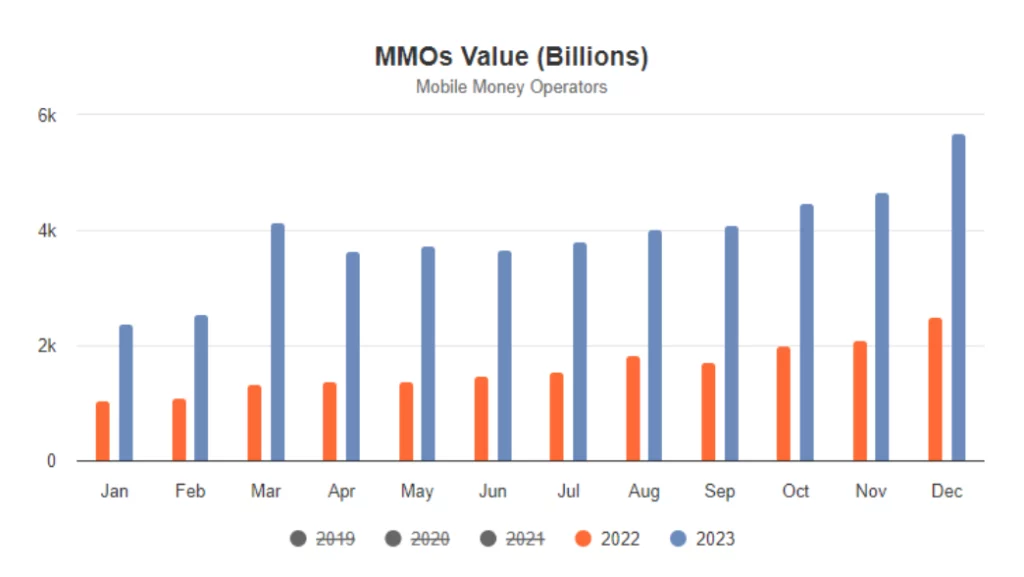

Nigeria Inter-Bank Settlement Systems (NIBSS) data has unveiled a staggering surge in mobile money transactions in 2023, with licensed operators such as Opay, Palmpay, and 15 others processing transactions valued at N46.6 trillion, marking the highest annual mobile money transactions in the country.

The data indicates a remarkable 140% increase compared to the N19.4 trillion transactions recorded in 2022 across mobile money platforms.

Notably, the volume of mobile money transactions also witnessed a remarkable uptick, soaring by 326% compared to the previous year. In 2022, the volume stood at 714 million transactions, while in 2023, it escalated to 3.04 billion transactions.

Driving Forces Behind the Surge

The surge in mobile money transactions can be attributed to various factors. Particularly, technical glitches experienced on banking apps early last year during cash scarcity prompted many Nigerians to adopt online banking, turning to mobile money operators for swift and seamless transactions.

The reliability and efficiency of transactions on these platforms further bolstered their popularity among bank customers.

READ ALSO: Managing Director Adekunle Adewole Steps Down from LivingTrust Mortgage Bank

Moreover, enticing offers such as free transfers and cashbacks provided by operators like Opay and Palmpay have attracted a larger customer base, further propelling the surge in mobile money transactions.

Licensed Mobile Money Operators

Our Source reports that there are currently 17 companies licensed by the Central Bank of Nigeria (CBN) as Mobile Money Operators. These entities play a pivotal role in facilitating mobile money transactions, offering a convenient alternative for financial transactions. It’s important to note that while there are over 200 fintechs in Nigeria, only 17 are licensed as mobile money service providers.

These licensed companies include Abeg Technologies Limited, Opay Digital Services Limited (formerly Paycom Nigeria Limited), Palmpay Limited, and others.

However, it’s worth mentioning that not all the licensed companies are currently providing the service, and some possess additional licenses enabling them to offer other services in the payment ecosystem.

The significant increase in mobile money transactions underscores the growing reliance on digital financial services in Nigeria, indicating a shift towards a cashless economy driven by technological advancements and changing consumer preferences.